Chapter 1: The Retirement Savings Odyssey

Let’s start with the basics. Retirement savings isn’t just about stashing away a chunk of your paycheck into a piggy bank. It’s an art, a science, and a bit of a guessing game.

Look to the experts

There are gazillions of opinions about how to retire comfortably, how much savings you need to retire, and all the ingredients that go into a happy retirement. A few resources stand out, among them several seminal books that have stood the test of time. These authors are highly regarded in personal finance circles and have a well-earned reputation for providing the best advice:

The Ultimate Retirement Guide for 50+: Winning Strategies to Make Your Money Last a Lifetime (Revised & Updated for 2023) by Suze Orman

Suze Orman is perhaps the most famous of the retirement guide gurus, and her seminal book on retirement, geared towards 50-somethings on the cusp of making the leap, demystifies the process and gives you a no-nonsense approach to planning your future.

Retirement Planning Guidebook: Navigating the Important Decisions for Retirement Success (The Retirement Researcher Guide Series) by Wade Pfau

This book has it all: the 4% rule, sequence-of-return risk, time segmentation and buckets, reverse mortgages, income annuities, variable annuities, fixed index annuities, long-term care insurance, living trusts, irrevocable trusts, budgeting, the funded ratio, Medicare Advantage… and much more. A thorough guide to planning your retirement.

How to Retire Happy, Wild, and Free: Retirement Wisdom That You Won’t Get from Your Financial Advisor by Ernie J. Zelinski

Zelinski talks about how retirement shouldn’t be so scary, and how some people can retire earlier than they thought… maybe even you!

Enter the Heroes: Retirement Savings Vehicles

- Individual Retirement Accounts (IRAs): The Traditional and Roth IRAs are like the wise wizards of retirement savings. The Traditional IRA offers tax-deferred growth, meaning you pay taxes when you withdraw in retirement. Roth IRAs, on the other hand, are the cool kids on the block. You pay taxes upfront, but withdrawals are tax-free in retirement.

- 401(k) Plans: The knights in shining armor. These employer-sponsored plans are powerful, especially with employer match programs. It’s like finding a treasure chest that keeps refilling itself.

- Health Savings Accounts (HSAs): The unsung heroes. Designed for healthcare expenses, they offer triple tax advantages. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

- After-Tax Vehicles: Think stocks, bonds, and mutual funds. These are the trusty steeds that carry you through the retirement battlefield, offering flexibility but also requiring careful strategy.

Chapter 2: The 4% Rule – A Guiding Compass

Picture this: You’re navigating the high seas of retirement planning, and you need a compass. Enter the 4% rule, a simple yet powerful tool discussed by the wise sage Mr. Money Mustache. It suggests that you can safely withdraw 4% of your retirement savings annually without running out of money. It’s like having a map that shows you how much treasure you need to collect before you can retire.

Read the classic 4% rule post from MMM here.

Chapter 3: Anticipating the Costs of Living in the Golden Years

Retirement isn’t just about sipping cocktails on the beach. There are costs, and some can be quite sneaky.

- Healthcare Costs: Like a kraken lurking in deep waters, healthcare costs can be massive and unexpected. Consider Medicare, supplemental insurance, and out-of-pocket expenses.

- Long-Term Care: As we age, the possibility of needing assistance with daily activities increases. Long-term care insurance can be a lifeboat in these situations.

- The Overlooked Expenses: Maintenance for your pirate ship – I mean, home – along with utilities, food, and transportation. And don’t forget about hobbies and travel!

How does your plan match up with history? The FIREcalc thinking.

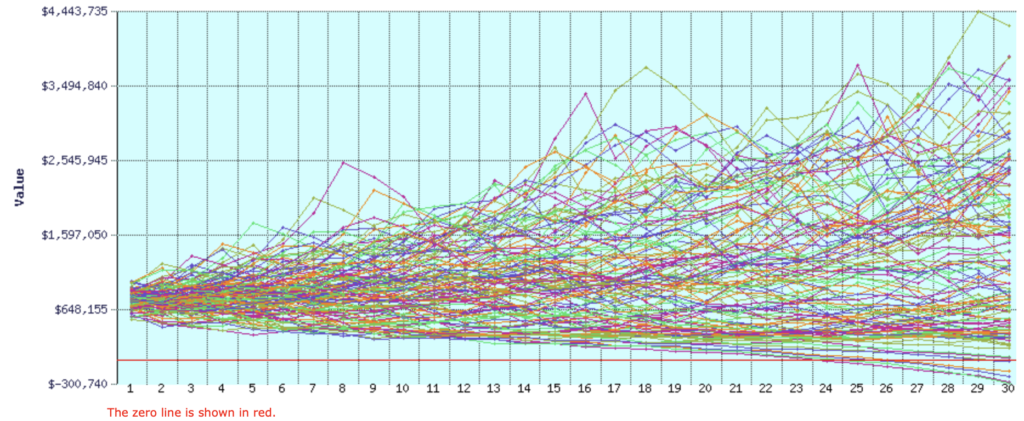

FIRECalc 3.0, a novel retirement calculator, offers a unique approach to planning financial independence and early retirement (FIRE). Unlike traditional calculators that rely on average historical returns, FIRECalc scrutinizes investment outcomes from 1871 to present, evaluating the success of your retirement strategy under various historical market conditions. It poses a critical question for those considering early retirement: Can you maintain your current lifestyle with your existing resources? The calculator illustrates this with vivid examples, such as the different outcomes of identical portfolios starting in the early 1970s. FIRECalc’s method isn’t about predicting future returns; rather, it’s about determining the likelihood of a retirement plan’s success based on past market data.

If you look at the mass of lines, and the zero axis, you can get a clear visual representation of how frequently your strategy would have succeeded (trend above the horizontal red line) or failed (dropped below the red line). The graph above was generated based on savings of $750,000, expenses of $30,000, and a timeframe of 30 years. The objective of presenting the information this way is to allow you to get a “big picture” sense of the way your strategy would have performed historically.

FIRECalc offers a comprehensive suite of tools for tailoring your retirement plan. It allows users to input annual spending, portfolio balance, and desired retirement duration, adjusting for factors like Social Security, pensions, and changes in spending habits. The calculator assumes a default ‘couch potato’ portfolio but provides flexibility to modify investment strategies and spending models. This customization extends to accounting for various life events, like receiving a pension or selling a property, and their impact on the retirement portfolio. FIRECalc’s interface guides users through various tabs to input and modify these factors, ensuring a holistic approach to retirement planning.

In essence, FIRECalc is a robust tool for anyone seeking financial independence and early retirement. Its historical analysis provides a unique perspective, enabling users to gauge the resilience of their retirement plan against diverse market scenarios. This includes considering worst-case scenarios like the Great Depression, thus offering a realistic and comprehensive assessment of one’s financial readiness for retirement. The calculator’s flexibility in accounting for various income sources, spending changes, and investment strategies makes it a valuable resource for personalized retirement planning.

Chapter 4: The Pitfalls and Perils on the Path to Retirement

Every adventure has its dangers, and retirement planning is no exception.

Underestimating Lifespan: Many people underestimate how long they’ll live. It’s like setting sail without enough provisions. When it comes to healthcare costs in retirement, think of them as a kraken, steadily growing larger as you age. On average, folks in their 70s might see annual healthcare costs hovering around $5,000 to $10,000, but as they sail into their 80s and 90s, these costs can skyrocket to $20,000 or more annually. This increase is due to several factors, like the need for more medications, more frequent medical visits, and higher chances of hospital stays. This escalating cost can rapidly deplete your net worth, especially if you haven’t planned for it. It’s like a slow leak in your boat that can eventually sink it if not addressed.

Ignoring Inflation: Inflation can erode your savings faster than a woodworm in a ship’s hull. Plan for it. Long-term care is the iceberg most don’t see coming. It’s not just about medical care; it’s also about assistance with daily living activities. The cost? Well, it’s not cheap. A private room in a nursing home can cost upwards of $100,000 per year! And since Medicare often doesn’t cover long-term care, it’s a significant financial burden that can rapidly deplete retirement savings. Unanticipated health events, like a sudden stroke or a diagnosis of Alzheimer’s, can force retirees to tap into their principal much earlier and more aggressively than planned, causing a domino effect on their overall financial stability.

Market Volatility: The stock market can be as unpredictable as the sea. Don’t put all your eggs in one basket. Most experts agree that the best strategy for investing includes broad selections from the stock mark, safe investments such as bonds, and a ratio of these that can be calculated based on when you intend to retire. The books listed above each dive into detail about these strategies.

Let the Good Times Roll!

Now, let’s not forget about the fun part of retirement – hobbies, travel, and leisure! Often, retirees meticulously plan for basic living expenses but overlook the costs associated with their dreams and aspirations. Want to travel the world? Yearn to pick up golf or painting?

These experiences, though enriching, come with price tags. Incorporating these expenses into your retirement plan is crucial. A good rule of thumb is to allocate a certain percentage of your annual budget for these ‘fun funds.’

After all, retirement is not just about surviving; it’s about thriving and enjoying the fruits of a life’s work.

Chapter 5: Avoiding the Pitfalls

- Diversify Your Portfolio: Like having a fleet of ships instead of just one.

- Stay Informed: Keep up with financial news and trends. Knowledge is power, after all.

- Consult a Financial Advisor: Sometimes, you need a navigator. A financial advisor can provide personalized guidance.

Chapter 6: The Treasure Map – Resources for Further Exploration

As we dock at the end of our journey, here are five treasure maps (aka resources) to continue your quest:

- Investopedia: A vast library of financial knowledge.

- The Motley Fool: For stock market enthusiasts and retirement planning.

- AARP: Focused on the 50+ crowd, with great retirement planning tools.

- NerdWallet: Offers a variety of financial tools and advice.

- Morningstar: A great resource for researching investments.

Retirement planning is a journey, not a sprint. It’s about making informed choices, adapting to changing tides, and sometimes, just enjoying the ride. May the winds be ever in your favor! 🏴☠️⚓🌅