The Quest for Financial IndependenceBest Practices to Achieving Financial Independence, and What To Do When You Get It

Financial independence: the Holy Grail of modern living. But what does it really mean? Is it lounging on a beach, sipping piña coladas, without a care in the world? Or is it something more profound? Let’s embark on an adventure to unravel the mysteries of financial independence, debunk myths, explore avenues to achieve it, and ponder life beyond the daily grind.

Chapter 1: Defining Financial Independence

Financial independence (FI) isn’t just about having loads of money. It’s the point where your assets generate enough income to cover your living expenses, freeing you from the need to work for money. It’s like having a golden goose that lays enough eggs to feed you, but not necessarily to throw lavish feasts.

If you haven’t yet read our article on retirement basics, read it here.

Common Misconceptions

Misconception 1: FI Equals Wealthy. Not necessarily. It’s more about managing expenses relative to passive income.

The concept of wealth often conjures images of luxury cars, mansions, and extravagant lifestyles. However, in the realm of financial independence (FI), wealth is more nuanced. It’s about having enough assets to generate passive income that meets or exceeds your expenses. This definition shifts focus from just accumulating assets to managing expenses in relation to income.

Understanding Net Worth and Wealth

Net worth is a key indicator of wealth. It’s the sum of all assets minus liabilities. However, a high net worth doesn’t automatically equate to FI. For instance, someone with a net worth of $2 million but annual expenses of $200,000 isn’t financially independent if their passive income doesn’t cover these costs. In contrast, an individual with a net worth of $1 million and annual expenses of $40,000, covered by passive income, achieves FI.

Managing Expenses for Financial Independence

When aiming for FI, it’s crucial to assess and manage your expenses. These include:

- Housing: Often the largest expense. Consider downsizing or relocating to a less expensive area.

- Transportation: Opt for more cost-effective modes of transport.

- Food: Plan meals, cook at home, and reduce dining out.

- Entertainment and Leisure: Seek out free or low-cost activities.

- Debts: Focus on paying off high-interest debts and avoid accumulating new ones.

- Reducing Expenses for Financial Freedom

Reducing expenses is a powerful strategy for achieving FI. It’s about making lifestyle choices that align with your financial goals. This might involve living in a smaller home, driving a less expensive car, and being mindful of discretionary spending. The goal is to create a sustainable lifestyle that maximizes happiness while minimizing costs.

In summary, financial independence is less about amassing a fortune and more about creating a balance where your passive income sufficiently covers your expenses. It’s a journey that involves both wealth accumulation and expense management.

Misconception 2: FI Means Early Retirement. Many achieve FI but choose to continue working.

Achieving financial independence (FI) is often equated with early retirement, but this is not always the case. Many people reach FI and choose to continue working, driven by factors beyond financial necessity.

Work as a Source of Satisfaction and Identity

For many, their career is more than a paycheck; it’s a source of personal satisfaction, identity, and social interaction. Continued work post-FI can provide a sense of purpose, intellectual stimulation, and maintain a structured routine. It’s about using one’s skills and passions in a way that feels fulfilling and contributes to personal and societal growth.

Combating Boredom and Loneliness

Retirement can lead to feelings of boredom and loneliness, especially for those who retire early or involuntarily. The workplace often provides social interactions and a sense of belonging, which can be lost upon retirement. It’s crucial for retirees to find new ways to engage socially and maintain a sense of community, whether through volunteering, joining clubs, or pursuing group hobbies.

Planning for Post-FI Life

Those approaching FI should plan not just their finances but also their post-retirement life. This includes considering:

- Continued Work: If work is satisfying, consider part-time or consultancy roles post-FI.

- Volunteering: Engaging in community service can provide social interaction and a sense of purpose.

- Pursuing Hobbies and Learning: Taking up new or existing hobbies and learning can keep the mind active and provide fulfillment.

- Physical Activity: Staying physically active is crucial for maintaining health and well-being.

In conclusion, achieving FI doesn’t necessarily mean an end to work. For many, it’s an opportunity to reshape their relationship with work, focusing more on personal satisfaction and less on financial necessity. As the research indicates, the mental health impacts of retirement can vary widely based on the nature of retirement and individual circumstances. It’s essential for those approaching FI to consider not just the financial aspect but also the social, emotional, and psychological dimensions of their post-FI life.

Misconception 3: It’s Only for High-Income Earners.

FI is achievable at different income levels through disciplined saving and investing.

The journey to financial independence is often perceived as a path reserved for high-income earners. However, the secret to early retirement isn’t necessarily in earning more, but in saving more and managing expenses effectively. This strategy is accessible to average salary earners as well.

Controlling Expenses and Saving Judiciously

- Living Below Your Means: The cornerstone of FI for average earners is living below one’s means. This involves creating and sticking to a budget that prioritizes savings and cuts unnecessary expenses. It’s about frugality – finding ways to reduce costs in housing, transportation, food, and entertainment.

- Increasing Savings Rate: The higher the percentage of income saved, the quicker the path to FI. For average earners, this often means saving a significant portion of their income, sometimes 50% or more.

The 4% Rule and its Role

The 4% rule is a widely accepted guideline in retirement planning. It states that you can withdraw 4% of your retirement savings each year, adjusted for inflation, without running out of money. This rule helps in calculating the total nest egg needed for retirement. For example, if your annual expenses are $40,000, according to the 4% rule, you would need a nest egg of $1 million (since 4% of $1 million is $40,000).

Case Study: $100,000 Salary Earner Planning for Early Retirement

Let’s consider an individual earning $100,000 per year who aims to retire in 10 years.

- Annual Income: $100,000

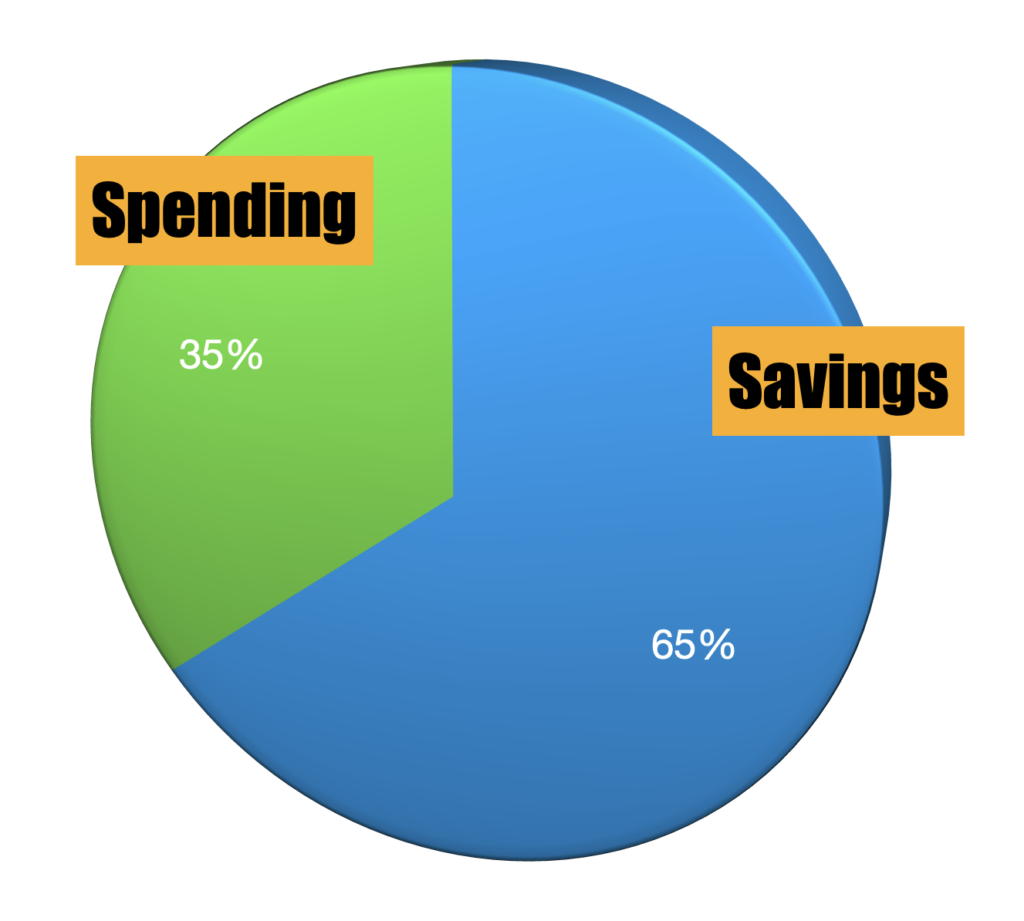

- Savings Rate: To retire in 10 years, they need to save about 65% of their income (based on the FI community’s general consensus).

- Annual Savings: 65% of $100,000 is $65,000.

- Living Expenses: This leaves $35,000 for annual living expenses.

Investment Strategy:

- The saved money ($65,000 annually) should be invested wisely, preferably in low-cost index funds or other diversified investments, to achieve an average annual return. Let’s assume a 7% average annual return, a conservative estimate considering the long-term average of the stock market.

After 10 Years:

- The total savings would be a substantial nest egg. This nest egg should ideally be large enough that 4% of it covers annual living expenses.

Analysis:

- Using a compound interest formula, in 10 years, the total amount saved would be significantly higher than the sum of the annual savings, thanks to the power of compound interest.

- If the annual living expenses can be maintained or reduced (adjusted for inflation), and if the investment continues to yield an average of 7% return, this individual could potentially retire or achieve FI in 10 years.

Conclusion:

Achieving FI on an average salary is about discipline, smart budgeting, aggressive saving, and wise investing. The 4% rule serves as a guiding principle in this journey, helping to determine how much one needs to save to cover expenses in retirement. This approach demonstrates that FI isn’t exclusive to high-income earners but is attainable for anyone willing to live below their means and prioritize saving and investing.

Learning the Ropes: The 5 Best Books on Achieving Financial Independence:

Here are ten highly-rated books on financial independence, along with a brief synopsis of each:

- Your Money or Your Life by Vicki Robin and Joseph R. Dominguez

A classic in personal finance, this book offers a nine-step guide to reshaping your relationship with money and achieving financial independence, emphasizing living below one’s means. - ChooseFI: Your Blueprint to Financial Independence by Jonathan Mendonsa, Brad Barrett, and Chris Mamula

This book provides straightforward tips and strategies for saving money and living below your means, key components of achieving financial independence and early retirement. - Financial Freedom by Grant Sabatier

Sabatier, who achieved financial independence in his 30s, shares a comprehensive guide covering budgeting, saving, investing, entrepreneurship, and estate planning to help readers create wealth and achieve financial freedom. - The Simple Path to Wealth by J.L. Collins

A straightforward guide focusing on simplicity in building wealth, it advises saving money, avoiding debt, and investing in diversified index funds. - Quit Like a Millionaire by Kristy Shen and Bryce Leung

This book offers a mathematical and evidence-based approach to achieving financial independence, debunking myths about money and retirement, and providing a strategy for saving, wise investing, and early retirement【18†source】. - The 4-Hour Workweek by Timothy Ferriss

Ferriss discusses ways to work less and live more, offering a comprehensive guide to balancing work and life, outsourcing tasks, and achieving financial independence.

Chapter 2: The Paths to Financial Independence

Several roads lead to the land of FI. Each has its charms and pitfalls.

- Frugality: Living below your means to save more. It’s like being on a permanent treasure hunt for savings. However, it can lead to a scrimping mindset, possibly missing out on life’s joys.

- Side Hustles: They’re like your financial sidekicks, providing extra income streams. The downside? They can consume your free time.

- Investing: Playing the long game, using compound interest as your trusty steed. But beware, the market is a wild beast that can buck unpredictably.

Chapter 3: Vehicles on the Road to FI

Your journey to FI will need some sturdy vehicles. Here’s a garage full of options:

- 401(k)s and IRAs: These retirement accounts are like your loyal pack mules, offering tax advantages and steady growth. However, they come with rules and penalties for early access.

- Stocks and Index Funds: Think of these as your racehorses. They can gallop fast, offering high returns, but can also be unpredictable.

- Real Estate: This is akin to building your own fortress. It offers rental income and potential appreciation. Yet it demands upkeep and can be a hassle to manage.

- Bonds and CDs: These are your safe havens, less risky but with modest returns. Like a calm river, they don’t rush but ensure a steady flow.

Chapter 4: Life Post-Financial Independence

Reaching FI is like arriving at a crossroads. What now? Without the need to work for money, you can:

- Continue Working: Many find fulfillment in their careers and choose to keep working, albeit with less pressure.

- Volunteer: Giving back to the community can be incredibly rewarding and helps maintain social connections.

- Pursue Hobbies: Always wanted to paint, write, or build ships in bottles? Now’s the time!

- Travel: With financial constraints lifted, the world is your oyster. Explore, learn, and experience new cultures.

Maintaining Physical and Mental Health

Transitioning from the daily grind to FI can be jarring. Here’s how to stay on top of your game:

- Stay Active: Keep your body moving. Whether it’s yoga, hiking, or golf, physical activity is crucial.

- Mental Engagement: Keep your brain sharp. Learn new skills, read, or take up challenging hobbies.

- Social Connections: Don’t become a hermit. Maintain old friendships and make new ones. Join clubs or groups that align with your interests.

- Routine: Develop a new routine that balances leisure with purposeful activities.

Conclusion

Financial independence is not just about securing your financial future; it’s about redesigning your life on your terms. It’s a journey filled with learning, discipline, and occasional setbacks. But with the right mindset and tools, it’s a journey that can lead to a life of fulfillment, purpose, and freedom. So set your sails, chart your course, and embark on this exciting adventure. The treasure of financial independence awaits! 🌟💰🏝️